Cryptocurrencies Get First Europe-Wide Regulation

The European Parliament approved sweeping powers to regulate the cryptocurrency industry, aiming to prevent money laundering and improve supervision and consumer protection.

Markets in Crypto-Assets (MiCA) rules, which go into effect in phases starting in 2024 and passed by a vote of 529-29, represent the most significant attempt by global governments to regulate the growing market for digital assets. The EU said in a statement that it hopes that the new law will be a “global standard-setter” for other jurisdictions. First proposed in 2020, MiCa represents a step forward on a regulatory front where the U.S. lags. President Joe Biden signed an executive order last year for government agencies to study the impact on the industry.

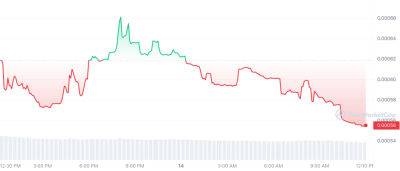

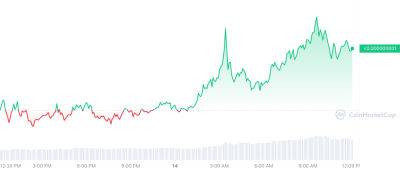

That was before the crypto meltdown that featured high-profile collapses, including the Terra project and the FTX exchange, prompted a crypto crackdown by the Securities and Exchange Commission (SEC), whose chairman, Gary Gensler, has referred to the crypto as «The Wild West.» A recent Treasury report also focused on illicit financing activity in the decentralized finance industry.

European Central Bank President Christine Lagarde, a key supporter of MiCA, called them an «absolute necessity» after the FTX implosion and even suggested a «MiCA II» that would build on the new law.

One of the biggest changes is the ability to track transactions above 1,000 euros ($1,097.55) from self-hosted wallets to centralized wallets, such as those hosted on crypto exchanges. The rules won't apply to peer-to-peer transfers or transfers that don't involve a centralized wallet.

Regulators will supervise the issuance of stablecoins that it classifies as “asset-reference and e-money tokens,” while providing oversight

Read more on investopedia.com