‘Biggest mistake’ is not using tax loss harvesting: Koinly head of tax

Failing to utilize tax loss harvesting is one of the biggest mistakes people make on their tax returns according to Danny Talwar, the head of tax at crypto tax software firm Koinly.

Speaking to Cointelegraph ahead of the April 18 United States tax deadline, Talwar said that for those investors who experienced losses in the market over 2022, this is the last chance to report the loss and "try and get some of that benefit" by offsetting it against any gains made last year.

Tax-loss harvesting occurs when an investor sells at a loss to offset the amount of capital gains tax owed from selling profitable assets.

"It's probably the biggest mistake people make, not realizing they can use tax loss harvesting," Talwar said.

However, he also noted that to claim a loss you "have to have realized the loss in some way."

"The IRS was quite clear that you can't claim a loss on something if its value has gone down and you haven't actually sold out of it."

Talwar says to be mindful that tax loss harvesting can lead some to commit a "wash sale," an IRS regulation that prevents an individual from selling or trading stock or security at a loss, then buying the same asset within 30 days of the sale.

As digital assets have not been classified as securities, crypto is currently not under these same rules, however, U.S. President Joe Biden's upcoming budget proposal has proposed a crackdown on crypto wash sales.

Talwar said the IRS may still investigate whether a transaction was genuine "if you're doing something just to get a tax benefit."

“I wouldn't be encouraging people to do it, but at the same time, people are doing it."

Related: What crypto hodlers should keep in mind as tax season approaches

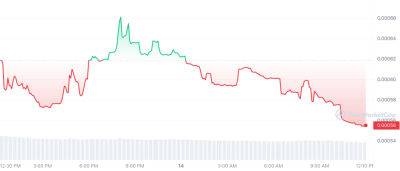

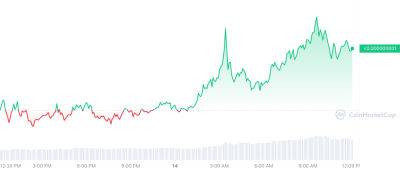

Talwar believes that those caught up in coin

Read more on cointelegraph.com