Crypto wrap: Market remains largely resilient despite Fed's 75 bps hike

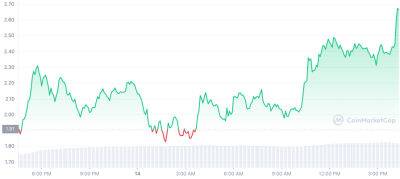

The cryptocurrency market was resilient despite a 75 basis points (bps) rate hike by the Federal Reserve, announced on Wednesday, market data showed. Total market capitalisation (m-cap) remained above $1 trillion, and the two biggest cryptos, by m-cap, Bitcoin (BTC) and Ethereum (ETH), stayed above $20,000 and $1,500 marks, respectively.

As of 1 PM (IST) on Friday, BTC was trading at $20,591, up 2 per cent in the past seven days, according to data from coinmarketcap. ETH was at $1,579, showing a jump of 5 per cent in the same period. The total m-cap of the crypto industry was at $1.02 trillion.

"The Federal Reserves' 75 bps rate hike was initially met with market cheer as it was on expected lines, but this outlook changed course sharply once chairman Powell's press conference began. He mentioned the need to recalibrate for a higher Terminal Rate which sent 'Risk On' assets into a downward spiral, with the S&P 500 dropping 2.5 per cent. Surprisingly, crypto markets remained resilient and have, in fact, ended the week in green," Parth Chaturvedi, crypto ecosystem lead at trading platform CoinSwitch, told Business Standard.

During the week, the Reserve Bank of India (RBI) also rolled out its pilot for India's central bank digital currency.

"If bulls can keep BTC above the current level, we might see upward momentum. But if bulls lose this initiative, we might see a bearish trend by the weekend," Edul Patel, CEO and co-founder of crypto investment platform Mudrex, said.

Ethereum fell below the $ 1,550 mark after the announcement but recovered quickly.

"If it closes above that level today, the next resistance would be at the $1,600 level. If not, ETH might fall to the $1,500 level and then to the $1,450 area in the coming

Read more on business-standard.com