The spectacular collapse of a $30 bn crypto exchange should come as no surprise

CANBERRA : Not long ago, FTX was one of the world’s largest trading platforms for cryptocurrencies. Founded in 2019, the Bahamas-based crypto exchange had a meteoric rise to prominence, and was valued at more than US$30 billion earlier this year.

All that has changed in the past two weeks. First, concerns emerged about links between FTX and an asset-trading firm called Alameda Research, including suggestions that customers’ funds have been transferred from FTX to Alameda.

A few days later, rival firm Binance (the biggest crypto exchange) announced it would sell its holdings of FTT tokens, a crypto that reportedly comprises much of Alameda’s assets.

Panicked customers rushed to withdraw funds from FTX, and the company is now on the brink of collapse, with a banner message on its website announcing it is “currently unable to process withdrawals".

This is not the first such rapid disintegration we have seen in the loosely regulated world of cryptocurrency, and it’s unlikely to be the last.

No rescuers in sight

The majority owner of both FTX and Alameda, Sam Bankman-Fried, had rescued other troubled crypto companies earlier this year. Now he is now desperately looking for an investor with a lazy $8 billion to save his companies.

Many firms have already written off the value of their stakes in FTX. So it will not be easy for Bankman-Fried to find investors willing to put in new funding.

Binance thought about taking over the troubled company outright. It decided against, citing concerns about allegations of misconduct and an investigation by the US Securities and Exchange Commission.

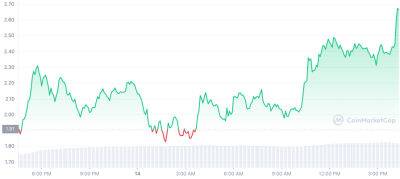

The price of FTT has now plunged. A week ago it was trading at US$24. Now it is at less than US$4.

Cautionary lessons

Trading in “assets" with

Read more on livemint.com