Terra Luna Classic Price Prediction as Do Kwon and Terraform Labs Lawyers Tell Judge They Did Nothing Wrong – Will LUNC Rise to $1?

The Terra Luna Classic price has fallen toby 1.5% in the past 24 hours, after lawyers for Terraform Labs and its co-founder Do Kwon asked a New York judge to throw out the SEC’s case against them.

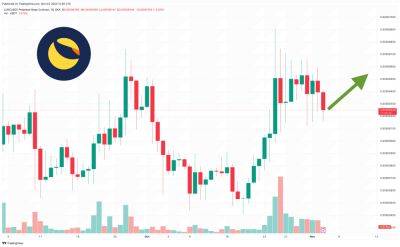

At $0.00006493, LUNC has risen by 6% in a week and by 13% in a fortnight, yet it remains down by 73% in the last 12 months.

This latter decrease suggests that LUNC may be in the middle of a long-term decline, something which the above case against Terraform Labs isn’t likely to help.

Yet with the surviving Terra Luna Classic community still working to boost the altcoin and its ecosystem, and it may still see further recoveries yet.

While LUNC has had a bad year, its indicator currently look fairly promising, in that they suggest further gains.

Its relative strength index (purple) has remained at around 65 after reaching 70 last week, a sign of continuing buying interest.

Its 30-day average (yellow) is also showing strength, rising towards its 200-day average (blue) and potentially signalling an incoming breakout rally.

That said, there are a couple of worrying signs that may given potential buyers some food for thought.

Firstly, LUNC’s support level (green) has declined consistently over the past few months, and while its actual price is clear of its support right now, the recent past suggests it could fall back down if market sentiment sours.

Secondly, it’s worth looking at the volume bars (in green and red) in the chart above, which show that the biggest volume spike in the past few days was for a selloff.

This suggests that holders are concentrating on exiting LUNC as soon as it provides them with any kind of gain.

This isn’t a particularly encouraging sign for LUNC’s future, although some observers may regard yesterday’s attempted

Read more on cryptonews.com