SEC Seeks Summary Judgment in Do Kwon and Terraform Labs Case, Citing Lack of Material Dispute for Trial

The U.S. Securities and Exchange Commission (SEC) has requested a federal judge for a summary judgment in its case against Do Kwon and Terraform Labs.

The SEC has argued in its filing that there is “no genuine dispute as to any material fact” in their case against Do Kwon and Terraform Labs.

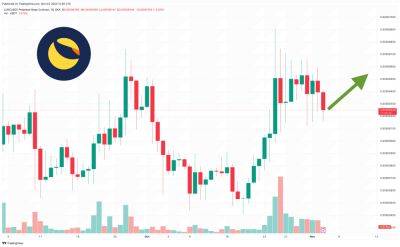

The US SEC has claimed that there is no dispute that purchasers had invested funds, whether through fiat currency or cryptocurrencies, and that Do Kwon and Terraform Labs had engaged in the sale of securities. The filing also mentioned that Terra’s collapse wiped out $45 bilion from the market.

The securities regulator emphasized that pooling money in a common enterprise with the expectation of profits primarily stemming from the efforts of the promoters aligns with the Howey test. Howey test is crucial legal criterion used to determine if a transaction qualifies as an investment contract.

SEC further stated that Terraform and Kwon had committed fraudulent acts and made deceptive statements.

The regulator reiterated allegations of deceiving investors regarding the stability of the UST stablecoin. The company falsely attributed its algorithm for price stabilization while clandestinely arranging third-party intervention.

These actions, the SEC contends, rendered their claims about the algorithm’s effectiveness misleading and omitted crucial information.

Terra’s collapse in May of the previous year resulted in the substantial loss of investor wealth, further fueling the SEC’s arguments.

Earlier, Do Kwon’s defense team urged the court to rule in their favor, asserting that the SEC had not sufficiently demonstrated that securities were being offered.

Do Kwon is currently serving a sentence in Montenegro for document forgery after being

Read more on cryptonews.com