How is crypto market different from stock market

The euphoria over the cryptocurrency continues to fascinate investors. Bitcoin and Ethereum continue to be favourite among the Indian crypto lovers. Despite being complex, the crypto market is evolving constantly, and is seen as a maturing industry with large investors parking their money in them.

Some people often confuse the crypto market with the stock market. So let's try and understand some basic difference between the two. Centralised The stock exchange market in India works under centralised regulation. It is regulated by the Reserve Bank Of India (RBI) and the Securities and Exchange Board of India (SEBI)

Cryptocurrencies are decentralised, which means that crypto operations and transactions are not controlled by any central bank.

“The FTX saga has created an urgent need to regulate crypto companies to safeguard user funds. European central bank president stated in favour of crypto regulations by calling it an 'absolute necessity. As we move forward, the contagion risk related to FTX collapse appears to be within the limits and can be solved with time," said Shivam Thakral, CEO of BuyUcoin. Fraud The regulator protects all participants, especially investors through special measures to safeguard them in case of stock markets but cryptos are more prone to fraud.

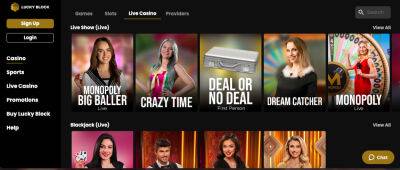

“In India stock markets are well regulated, participants, companies, brokers etc have to undergo rigorous monitoring and training and have to comply with SEBI, the regulators requirements on a continuous basis. The regulator protects all participants, especially investors through special measures to safeguard them. Price fluctuations are determined through demand and supply which are further dependent on company performance and prospects. Should a fraud

Read more on livemint.com