Total crypto market cap takes another hit, but traders remain neutral

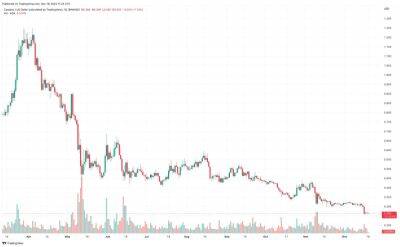

The total cryptocurrency market capitalization dropped 8.1% in the past two days after failing to break the $880 billion resistance on Dec. 14.

The rejection did not invalidate the 4-week-long ascending channel, but a weekly close below $825 billion will confirm a shift to the lower band and reduce the support level to $790 billion.

The overall investor sentiment toward the market remains bearish, and year-to-date losses amount to 66%. Despite this, Bitcoin (BTC) price dropped a mere 2% on the week, down to the $16,800 level at 17:00 UTC on Dec. 16.

A far different scenario emerged for altcoins which are being pressured by pending regulation and fears that major exchanges and miners could be insolvent . This explains why the total market capitalization had dropped by 4.7% since Dec. 9.

According to court documents filed on Dec. 15, a United States Trustee announced the committee responsible for part of FTX's bankruptcy proceedings. Among those is Wintermute Asia, a leading market maker and GGC International, an affiliate of the troubled lending platform Genesis. Investors remain in the dark about who the biggest creditors from the failed FTX exchange group are and this is fueling speculation that contagion could continue to spread.

On Dec. 15, The central bank of the Netherlands issued a warning to investors using KuCoin, saying the exchange was operating without legal registration. De Nederlandsche Bank added that the crypto firm was "illegally offering services" and "illegally offering custodian wallets" for users.

Adding to the drama, on Dec. 16, Mazars Group, a company known for its proof-of-reserve audit services for crypto companies, reportedly removed recent documents that detail exchange audits from its website. The

Read more on cointelegraph.com