How did Binance, FTX deal push crypto markets into a frenzy?

Cryptocurrencies have corrected significantly this week with Bitcoin trading below the 18,000 mark. The reason why cryptocurrencies are hurting is due to a panic selloff in the native token of the crypto exchange FTX. Investors seem to have riled up after insolvency rumors sparked for FTX despite the exchange's founder and CEO Sam Bankman-Fried assuring that they are fine. It's not just fear over FTX's financial position and its sister company Alameda's balance sheet. The future looks even bleaker for SBF's FTX after Changpeng Zhao-led Binance pulled away from the acquisition deal. Both BNB and FTT are the most trending cryptos on Thursday.

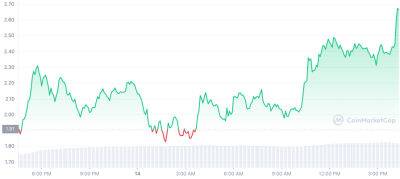

Binance's native token BNB is currently trading at nearly $310 on CoinMarketCap, at the time of writing. Its market cap is around $49.54 billion. BNB is the top trending cryptocurrency currently.

On the other hand, FTX-backed FTT is struggling to hold around $3.4 levels. FTT's market cap is around $458.17 million.

It all began when a Coindesk report alarmed about Alameda's balance sheet whose foundation was largely made up of coins that it's sister company FTX invented. This raised the question of solvency in Alameda didn't have an independent asset like a fiat currency or another crypto.

As per the report, Alameda's assets are worth around $14.6 billion --- of which --- $3.66 billion and locked in FTT, while its third largest assets were worth around $2.16 billion in FTT collateral. This means, more than $5 billion of Alameda's assets are FTT.

This led sparked rumours of insolvency in FTX. But things further went south when Binance announced that they are liquidating their holdings of FTT tokens as they wanted to be cautious after their experience from the LUNA crash. Investors

Read more on livemint.com