FTX Customers May See 90% Asset Return by Q2 2024 in Amended Proposal

Customers of the now-bankrupt cryptocurrency exchanges FTX and FTX.US are looking forward to the possibility of reclaiming more than 90% of their assets as part of an amended proposal.

This plan aims to return funds that were held by the exchange before its collapse in November of the previous year.

The group of debtors responsible for overseeing the bankruptcy proceedings will formally submit this revised proposal to a U.S. Bankruptcy Court for consideration by December 16, 2023.

Under this proposal, missing customer assets will be divided into three distinct pools based on their circumstances when the Chapter 11 cases began.

The first two pools are designated for assets that belong to FTX.com and FTX.US customers, respectively.

A "General Pool" will hold other assets. Notably, customers with preference settlement amounts of less than $250,000 can accept the proposed settlement without any reduction in their claim or payment.

The preference settlement, equivalent to 15% of customer withdrawals made on the exchange within nine days before its bankruptcy, will be available without reduction for eligible customers whose claims are less than $250,000.

However, the anticipated asset recoveries may face challenges due to factors like taxation, government claims, and the fluctuation of token prices.

The debtors may exclude insiders, affiliates, or customers who were involved in the commingling and misuse of customer deposits and corporate funds, as well as those who modified their KYC information to facilitate withdrawals during the suspension.

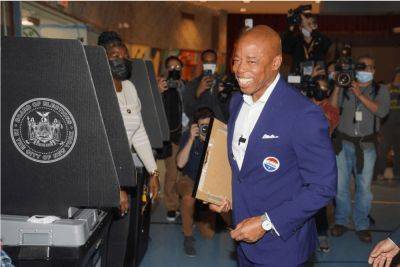

FTX, which experienced a high-profile collapse last year following revelations about its financial state, has been undergoing significant changes.

The newly appointed CEO, John J. Ray III,

Read more on cryptonews.com