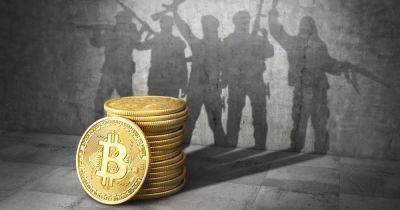

Nishad Singh testifies on Sam Bankman-Fried's 'excessive' investments through Alameda

Former FTX engineering director Nishad Singh reportedly told a New York courtroom that former CEO Sam “SBF” Bankman-Fried had a habit of deciding on purchases through Alameda Research by himself.

According to reports from SBF’s criminal trial on Oct. 16, Singh said while Caroline Ellison and Sam Trabucco led Alameda, Bankman-Fried was “ultimately” in charge of the company. The former engineering director reportedly testified that “SBF would unilaterally spend Alameda's money” despite his supposedly separate role at FTX, also threatening to fire Ellison.

“I learned of spending [at Alameda] after the fact,” said Singh according to reports. ”I'd complain about the excess and flashiness which I found different than what we were building the company for. [SBF would] say I didn't understand, he was out there interacting with people. I thought we were fleeced for $20 million, he said I was sowing doubt.”

Singh added:

The former engineering director reportedly cited investments in artificial intelligence startup Anthropic and K5 Global, the investment firm linked to high profile figures including former United States Secretary of State Hillary Clinton and Hollywood celebrities. According to Singh, SBF ordered him and former chief technology officer Gary Wang to go ahead with a $1-billion investment in K5 Global co-owners Michael Kives and Bryan Baum’s venture capital firm.

“I asked that it be done with Sam's money and not FTX's money,” said Singh according to reports.

Subscribe to our ‘1 Minute Letter’ NOW for daily deep-dives straight to your inbox! ⚖️ Be the first to know every twist and turn in the Sam Bankman-Fried case! Subscribe now: https://t.co/jQOIYUv6IW #SBF pic.twitter.com/gp7zJu5sgy

Singh’s testimony came on the ninth day

Read more on cointelegraph.com