FinMin proposes to tighten cryptocurrency taxation

The government on Thursday proposed to tighten the norms for taxation of cryptocurrencies by disallowing set off of any losses with gains from other virtual digital assets.

In a big jolt for the crypto industry, the government has recently clarified that as per the Budget 2022 proposals, investors will not be allowed to set-off losses in one crypto asset against another.

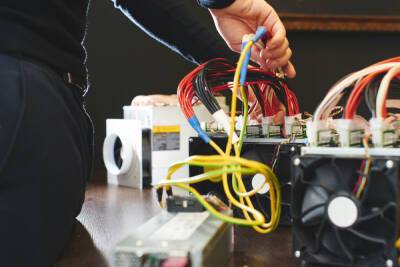

Further, mining infrastructure will not be eligible to be deducted as the cost of acquisition.

On 1 February, the government had announced a 30% tax on any income from the transfer of virtual digital assets (VDAs) or crypto assets. The tax proposal covered all emerging digital assets, including non-fungible tokens (NFTs), assets in metaverse, digital currencies and tokens, among others.

Along with the 30% tax, the Union Budget 2022-23 has also proposed a 1% TDS on the transfer of such assets.

As per the amendments to the Finance Bill, 2022, circulated among the Lok Sabha members, the ministry proposes to remove the word 'other' from section relating to set off of losses from gains in virtual digital assets.

This would mean that loss from the transfer of VDAs will not be allowed to be set off against the income arising from the transfer of another VDA.

According to the Finance Bill, 2022, a VDA could be a code or number or token which can be transferred, stored or traded electronically.

Tax experts were split on whether investors could set-off losses in one crypto against another crypto asset. Set off of losses means adjusting the losses against the profit or income of that particular year. This provision is available in stock investments.

The government in the Budget for 2022-23 has for the first time provided definition for crypto assets and set out a

Read more on livemint.com