Ethereum price turns bullish ahead of next week’s Shanghai and Capella upgrade

With one week to go until the Ethereum (ETH) Shanghai and Capella upgrades on April 12, all eyes are on Ether. The second largest cryptocurrency by market capitalization shrugged off rumors and regulatory action against exchanges to hit a 7-month high of $1,922 on April 5.

Ether price has momentum and here are three strong reasons why.

According to data from Cointelegraph Markets Pro and TradingView, despite market volatility, Ether price has posted gains on the 7-day, 1-month and 3-month timeframes. Ether price gains are also notable on the year-to-date perspective, showing 59% growth.

Ether’s ability to break resistance levels is leading some analysts to believe a $3,000 price target is on the horizon in Q2 2023. The trend shows that whale accumulation remains strong, growing by 0.5% in March according to data from analytics provider Santiment.

The bullish buying activity may prove on-chain data correct that Ether sell pressure after the Shanghai hardfork will be a non-event.

Related: US enforcement agencies are turning up the heat on crypto-related crime

The uptick in proof-of-stake validation by placing Ether in staking contracts is bullish for the Ethereum ecosystem. Since launching on Aug. 4, 2021, the Ethereum network has witnessed over 18 million in Ether staked on the blockchain.

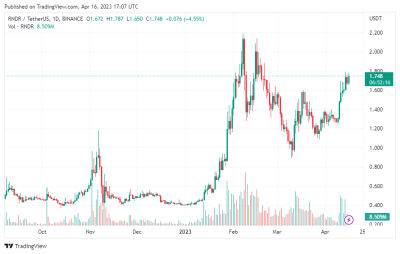

The emergence of liquidity staking derivatives has reduced the barrier to entry to participate in Ether staking. The leader in LSDs and the largest single entity by value, Lido has close to one-third of all staked Ether. Including interest received, Lido contracts hold 5.9 million Ether from 137,000 unique depositors.

The total value locked in the Ethereum network is also rising, partially as a result of Lido’s protocol comprising

Read more on cointelegraph.com