Coinbase officers, board members face suit over alleged insider trading during listing

A Coinbase shareholder has filed a stockholder derivative complaint against some of the company’s executives and board members, claiming they profited from inside information during the company’s public listing. CEO Brian Armstrong and well-known venture capitalists are among the defendants.

A stockholder derivative complaint is a suit filed against a company on behalf of its stockholders. Coinbase shareholder Adam Grabski filed the suit in the Delaware Court of Chancery on May 1. Grabski bought Coinbase shares on the first day of the crypto exchange's public listing.

According to a redacted version of the complaint posted by the court, the defendants were able to sell $2.9 billion worth of Coinbase shares made available to the public through a direct listing of the company’s stock on the Nasdaq exchange on April 14, 2021, and in the week that followed.

Fascinating lawsuit discusses Coinbase board’s confidential plan to go public two years ago> The process was given the internal nickname “Project Fall Fruits”.The project was indeed, er, fruitful. Look who got rich:$COIN pic.twitter.com/FUGT2g5ZEx

If the company had made an initial public offering instead of directly listing on the exchange, the defendants would have been prevented from selling their shares, and the value of the shareholdings would have been diluted.

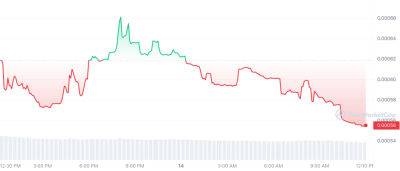

The suit alleges that the defendants were able to sell their shares before disclosing information they already had that negatively affected the share price, which fell by more than 37% by May 18, after “the compression of the Company’s revenue margins during the first fiscal quarter and the issuance of a dilutive convertible offering were publicly disclosed.” According to the suit:

The company lost over $37

Read more on cointelegraph.com