Coinbase Chief Legal Officer Pushes Back Against US SEC Crypto Custody Rule Proposal

Coinbase’s chief legal officer called a newly proposed US rule tightening cryptocurrency custody requirements “misguided” and said some parts need to be changed.

The Securities and Exchange Commission rule was proposed in February and would require registered investment advisers to keep crypto with a qualified custodian, which would mandate certain requirements such as segregating investors’ assets.

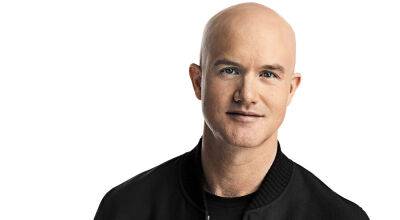

The exchange generally agrees with the proposal, said Chief Legal Officer Paul Grewal on Twitter, while adding that Coinbase Custody Trust Company will remain a qualified custodian if the proposal is adopted as is.

A qualified custodian maintains client funds and can be entities like a bank or broker-dealer.

“That said, like other recent SEC actions, this proposal unnecessarily singles out crypto and makes inappropriate assumptions about custodial practices based on securities markets,” Grewal tweeted on Monday night.

At the time, SEC Chair Gary Gensler said some crypto platforms claim to custody investors’ crypto, but it does not mean they are qualified custodians, while also citing concerns about commingling assets.

“Make no mistake: Based upon how crypto platforms generally operate, investment advisers cannot rely on them as qualified custodians,” Gensler said in February.

The rule asks for comment on whether the definition of a qualified custodian should be narrowed to banks subject to federal regulation, but Grewal said the agency should recognize state trust and state-regulated firms as qualified custodians.

“Thus, including them as a class of qualified custodians promotes competition, efficiency, and investor protection,” Grewal said in a letter sent to the SEC on Tuesday.

Grewal also proposed limiting exposure to

Read more on cryptonews.com