Coinbase CEO says UPI payments suspended due to 'informal pressure' from RBI

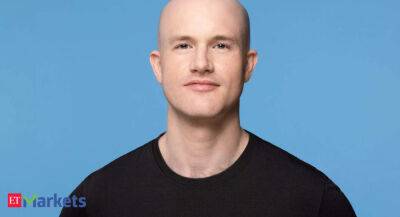

The chief executive of Coinbase said the US-based crypto trading firm disabled its Unified Payments Interface or UPI services because of "informal pressure" from the Reserve Bank of India (RBI).

In a strong-worded response, Brian Armstrong said, "So a few days after launching, we ended up disabling UPI because of some informal pressure from the Reserve Bank of India, which is kind of the Treasury equivalent there."

Speaking at the firm's earnings call to discuss the first quarter financial results, Armstrong said, "India is a unique market, in the sense that the Supreme Court has ruled that they can't ban crypto, but there are elements in the government there, including at the Reserve Bank of India, who don't seem to be as positive on it."

"And so they in the press, it's been called a shadowban; basically, they're applying soft pressure behind the scenes to try to disable some of these payments, which might be going through UPI," Armstrong said.

The CEO believes that Coinbase will be live back in India in relatively short order along with a number of other nations where they're pursuing international expansion similarly.

Just few days after the launch in April, Coinbase had removed the option of adding UPI as a payment method on its app.

On 7 April, Coinbase had announced it would allow Indian users to use UPI as a a payment method to buy and sell crypto.

However, within hours of the Coinbase announcement, National Payments Corporation of India (NPCI), said it was not aware of any crypto exchange using UPI.

Meanwhile, Coinbase is planning to quadruple the number of employees in India by year-end, the CEO had said earlier in a blog post, adding 1,000 to the existing 300 staff at its Indian tech hub, which started last

Read more on livemint.com