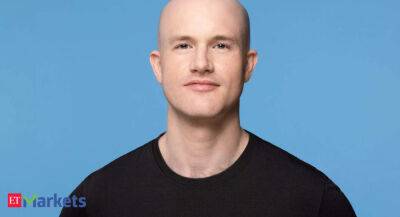

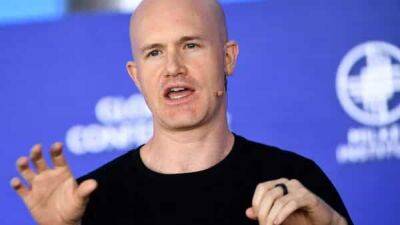

Coinbase admits RBI's use of informal pressure prompted halting of trade

The tussle between India’s apex financial institution Reserve Bank of India and the crypto industry is finally out. Brian Armstrong, co-founder and chief executive of Nasdaq-listed Coinbase said the company disabled UPI payment from its platform due to informal pressure from RBI.

Armstrong also stated that the RBI and government have been applying soft pressure to disable some of these payments. “India is a unique market, in the sense that the Supreme Court has ruled that they can't ban crypto, but there are elements in the government there, including at Reserve Bank of India, who don't seem to be as positive on it. And so they -- in the press, it's been called a "shadow ban," basically, they're applying soft pressure behind the scenes to try to disable some of these payments, which might be going through UPI,” said Armstrong in the analyst call post the company’s results.

Armstrong also said that this stance of RBI is actually against the ruling of the Supreme Court. “My hope is that we will be live back in India in relatively short order, along with a number of other countries, where we're pursuing international expansion similarly. I think our preference is really just to work with them and focus on relaunching,” he said.

Coinbase had started its services in India in April this year. The company had then said that crypto traders in India can sign up on the platform with their Aadhaar cards and use their United Payments Interface (UPI) accounts to buy and sell crypto on the app.

“Coinbase has a long-term plan for investing in India. It has a lot of engineering and entrepreneurial talent, and has shown a lot of willingness to embrace new technologies”, founder and CEO Brian Armstrong said at an event in Bengaluru. But

Read more on business-standard.com