Chinese Central Bank Unveils SIM Card-based Offline CBDC Wallet

The Chinese central bank has unveiled an offline SIM card-based digital yuan “hard” wallet solution that lets users pay with the central bank digital currency (CBDC) with powered-down phones.

The innovation could eventually allow 2G phone-owning citizens to use their handsets to use the token when their phones are off.

A similar solution for smartphone users was unveiled earlier this year, but made exclusive use of the near field communication (NFC) technology used in most modern handsets.

The new innovation makes use of hardware embedded on SIM cards, rather than only on the handsets.

Per the Securities Times, the central People’s Bank of China (PBoC) has updated its app to allow Android phone users to use their SIM cards as “hard” (offline) CBDC wallets.

The PBoC’s mobile and banking partners have also announced the launch of SIM card-based “hard wallet products.”

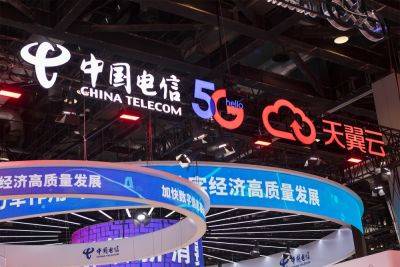

This group includes the telecoms giants China Mobile, China Telecom, and China Unicom, as well as the state-owned commercial banks the Industrial and Commercial Bank of China and the Bank of China.

The PBoC partner firms claimed that the “launch of this new function” would “greatly expand the scope of the use” of the digital yuan’s power and network-free “payment functions.”

Citizens will need to obtain a “super SIM card” from their carriers in order to make use of the new innovation.

After replacing their existing SIM cards with a “super SIM,” they will need to launch the digital yuan app on their phones, where they can find an option to “open a SIM card hard wallet.”

This will allow them to use their devices to make “touch” payments to merchants when their devices are powered down or have no network connection.

The media outlet wrote that “at present” the innovation

Read more on cryptonews.com