GMX Price Prediction as GMX Slumps 6.5% - Here’s Where the DEX Token Could Be Headed Next

GMX, the governance and utility token that powers GMX, an Arbitrum-based decentralized exchange (DEX) for trading perpetual cryptocurrency futures with leverage, has tanked around 6.5% in the last 24 hours, as per CoinGecko.

That makes gives it the unwelcome crown of being the worst-performing cryptocurrency in the top 100 by market capitalization over this time period.

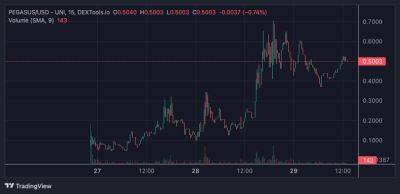

GMX/USD fell to just above $50 per token on Friday, dropping below its 50-Day Moving Average (DMA) just above $53 in the process, having lost its grip on its 21DMA near $56 earlier in the week.

The latest decline has seen GMX fall its lowest levels in over a month, with the cryptocurrency now 18% lower versus its highs from earlier in the month around $62.

There doesn’t seem to be any particular new catalyst of note behind the GMX price decline in recent days.

But a quick look on DeFi Llama shows that the protocol’s trade value locked (TVL) in its smart contracts has been falling in recent months.

The protocol’s ETH-denominated TVL was last just under 500,000 ETH, down from over 700,000 in February.

Its USD-denominated TVL, meanwhile, was last just under $1 billion, down from over $1.26 billion earlier in the year.

The falling ETH-denominated TVL suggests that the protocol is struggling to keep hold of crypto capital, which isn’t a good sign, perhaps explaining recent GMX token underperformance.

After the rejection of the 100 and 200DMAs when GMX peaked above $60 earlier this month sent a strong bearish signal, GMX’s latest decline below the 50DMA (meaning it is below all its major moving average) confirms that the bears are back in full control.

In the absence of any key levels of support aside from the late-June lows just above $50, a fall back to June lows in

Read more on cryptonews.com