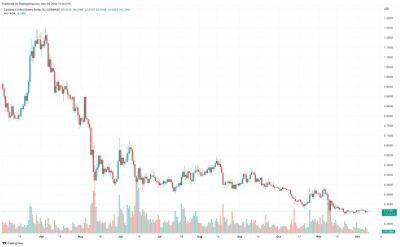

Bitcoin Price Prediction as BTC Bounces From $16,000 – Can it Go Lower?

On November 29, the Bitcoin price prediction remained bearish under the $16,650 resistance level as the "Risk-off" sentiment continued to dominate the global financial markets. BlockFi is the latest victim of the FTX collapse, and it's a lender in the troubled cryptocurrency space that has filed for bankruptcy.

BlockFi and eight affiliates filed for Chapter 11 bankruptcy in a US bankruptcy court in New Jersey on November 28. The filling will enable the firm to stabilize its operations and finalize a comprehensive restructuring agreement that maximizes value for all clients and other stakeholders.

BlockFi, a New Jersey-based company, stated that it owed money to over 100,000 creditors. As its second-largest creditor, it listed FTX, a cryptocurrency exchange, owing $275 million.

Early in 2022, BlockFi encountered difficulties as a result of a sharp drop in cryptocurrency prices, which resulted in customer withdrawals and the liquidation of assets from the struggling Singapore-based Three Arrows Capital.

Over the summer, the company received a $400 million credit line from FTX, which allowed the lending company to avoid bankruptcy. On November 11, however, FTX declared bankruptcy.

In the United States, a company can file for Chapter 11 bankruptcy to restructure its debts while operating under court supervision. The news that cryptocurrency lender BlockFi had filed for bankruptcy led to a drop in the value of BTC/USD.

Singapore's senior minister, Tharman Shanmugaratnam, stated on November 28 that banks in the country must hold $125 in capital for every $100 exposure to risky crypto assets such as Bitcoin (BTC) and Ethereum (ETH).

In a written response to Singapore's parliament, Shanmugaratnam claimed that Singaporean banks have

Read more on cryptonews.com