Binance tops up SAFU fund at $1 billion amid price fluctuations

As the liquidity crisis and acquisition of cryptocurrency exchange FTX continues, Binance CEO Changpeng “CZ” Zhao assured his community of insurance of sufficient funds backing the network.

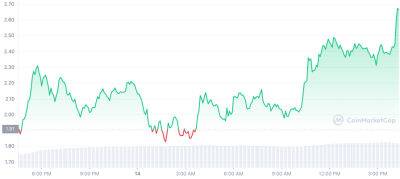

In a tweet on Nov. 9, CZ said that the exchange has once again topped its Secure Asset Fund for Users (SAFU) at $1 billion equivalent in light of “recent price fluctuations.”

To adjust to recent price fluctuations, #Binance has topped up the #SAFU insurance fund to $1 billion USD equivalent again.BUSD AND BNB address about 700m: https://t.co/OMoB6HeR6rBTC address 300m: https://t.co/6kOJ1MZhMMTransparency. 1/2

The tweet included links to two reserve accounts, one of which holds both the Binance stablecoin (BUSD) and the native token of the network Binance Coin (BNB) with an equivalent worth of $700 million.

The other wallet revealed Bitcoin (BTC) holdings worth around $300 million.

Binance’s SAFU began in 2018 by allocating 10% of the trading fee into a fund that is solely dedicated to backing up user holdings in the case of an incident. In February of this year, the fund hit $1 billion for the first time.

The crypto community on Twitter responded to the tweet with mostly positive reactions, applauding CZ for his action. One user said “all cryptocurrency firms should have a Secure Asset Fund for Users (SAFU) just like Binance.”

While others had questions about the sufficiency of the cap for funds in the reserve:

Does #Binance keep less than $1 Bil in users funds in hit wallets?Could there be any scenario where Binance needs more than the $1B?

These recent tweets regarding the balance of the SAFU, came after CZ pledged on Twitter the day before for a Proof-of-Reserve mechanism for a detailed disclosure of liquidity.

The Binance CEO said the

Read more on cointelegraph.com