Bitcoin price consolidation has shifted traders to these 4 altcoins

Bitcoin (BTC) has been trading in a tight range since Thanksgiving Nov. 24, as traders are uncertain about the next directional move. Usually, in a bear market, analysts tend to become uber-bearish and project targets that tend to scare away investors.

The failure of Bitcoin to start a strong recovery has given rise to several bearish targets, which extend up to $6,000 on the downside.

Although anything is possible in a bear market, traders who have a long-term view could try to accumulate fundamentally strong coins in several tranches. Because a bottom will only be confirmed in hindsight and trying to time it is usually a futile exercise.

In a bear market, all coins do not bottom at the same time. Hence, along with keeping an eye on the broader cryptocurrency market, traders should closely follow the coins of their choice.

The cryptocurrencies that lead the market out of the bear phase generally tend to do well when the next bull market begins. Let’s look at the charts of the cryptocurrencies that are trying to start an up-move in the short term.

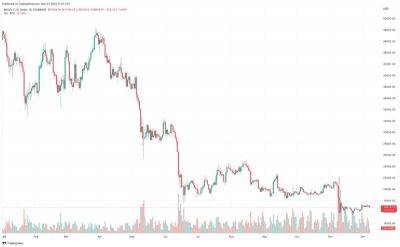

Bitcoin has been consolidating between $15,588 and $17,622 for the past few days. The relative strength index (RSI) has formed a bullish divergence, suggesting that the selling pressure could be reducing.

The relief rally could face stiff resistance in the zone between the 20-day exponential moving average ($17,065) and $17,622. If the price turns down from the overhead zone, the BTC/USDT pair could extend its stay inside the range for some more time.

If buyers catapult the price above the overhead zone, it will suggest that the downtrend may be ending. The 50-day simple moving average ($18,600) may act as a minor hurdle but if crossed, the up-move could reach the psychological

Read more on cointelegraph.com