XRP Price Prediction as Judge Torres Grants SEC's Ripple Case Appeal Process – Will XRP Fall to 1 Cent?

While XRP is trading more than 16% up from Thursday’s lows and is back to the north of its 200DMA and the psychologically important $0.50 level, the world’s fifth-largest cryptocurrency by market capitalization continues to trade lower by around 20% on the week.

XRP, the token that powers the XRP Ledger which was launched by US fintech firm Ripple Labs more than one decade ago, has fallen hard this week amid a broader rout in the cryptocurrency market that has seen other major tokens like Bitcoin (BTC) and Ether (ETH) also take a big hit.

A few things have been weighing on broad crypto sentiment.

Firstly, macro has been a headwind in recent weeks – US long-dated bond yields are back near multi-year highs as traders bet the strong US economy means higher interest rates for longer, while US stocks (correlated to crypto in recent years) have been pulling back.

Thinner than usual August liquidity conditions, which mean the month is often volatile and bearish (in the stock market, at least), have also been cited.

The fact that Bitcoin and Ether both broke below major support levels, calling their 2023 uptrends into question, has also weighed heavily on sentiment.

The net result for XRP is that it is now down nearly 50% from the more than 1-year highs it hit earlier this year in the $0.90s.

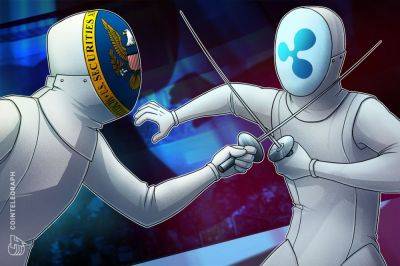

Another factor likely to be weighing on XRP specifically is the fact that a US judge just handed the US Securities and Exchange Commission (SEC) a lifeline in its lawsuit against XRP’s issuer Ripple Labs.

Judge Torres, who is presiding over the case, just approved the SEC’s appeal to file an interlocutory appeal in wake of a key decision she issued last month.

Back in July, Torres ruled that Ripple’s electronic/algorithmic sales of XRP to retail

Read more on cryptonews.com