With continued Bitcoin adoption comes tamer price action, trader argues

Episode 9 of Cointelegraph’s Crypto Trading Secrets podcast is now live. In the episode, host Benjamin Pirus chats with Cheds, aka @BigCheds on Twitter. A trader, analyst and author, Cheds fielded an array of questions during the April 6 episode recording, including his opinion on whether Bitcoin’s (BTC) price will ever become less volatile during its bull and bear markets.

“Definitely,” Cheds responded when asked. “I think the more institutionalized it is, the more it becomes part of everyday life and more just part of the system. I think the volatility will wane over time — I definitely do.”

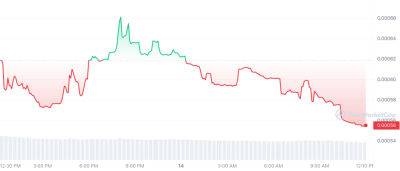

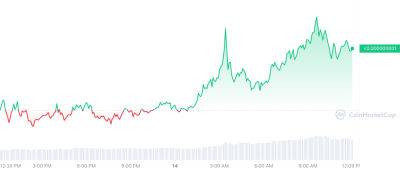

Bitcoin launched in 2009 and has since sustained massive price fluctuations. Those huge fluctuations were especially apparent between 2015 and 2018, when the asset surged from below $300 to almost $20,000 before plunging back down below $4,000, according to Cointelegraph’s BTC price index. In the following years, the asset ultimately rose back up to nearly $70,000 before falling below $16,000.

In past years, Bitcoin has gone from a largely unknown asset to one in which players such as MicroStrategy and Tesla have invested. If Bitcoin continues its path further into the mainstream, however, the asset’s price could become less volatile, according to Cheds.

Regarding the concept of Bitcoin’s bull runs, Cheds believes technical price trends represent a better depiction of what’s happening. “A bull run — these are narratives more than anything,” Cheds said as part of his answer to a separate question. “An uptrend — it’s a technical term based on what the price is doing,” he continued. “A bull run, I mean, could mean a lot of different things, so I don’t know that those two are interchangeable,” he added, referring to the term “bull run”

Read more on cointelegraph.com