Will disclosing proof of reserves bring back trust to the crypto ecosystem?

Trust – Once lost is difficult to regain.

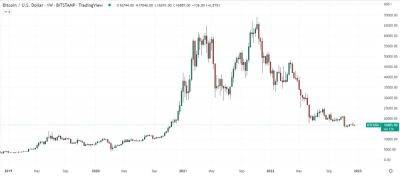

The collapse of FTX, one of the world’s largest cryptocurrency exchanges, and losses to the tune of billions of dollars have raised questions on the legitimacy of the crypto realm.

The reliability of centralised exchanges, crypto wallets, and even well-known developers are hot topics of discussion among those with even the slightest knowledge of digital currencies.

One way being touted to bring in further transparency and boost public confidence is regular publication of proof of reserves by crypto exchanges and other service providers. This is expected to demonstrate that these exchanges have the crypto assets they claim publicly.

What is proof of reserves?

Proof of reserves is the disclosure of the amount of reserve assets that an exchange has in place to cover potential customer withdrawals.

There are a few ways to prove reserves, but the most popular one is for the exchange or wallet to offer a cryptographic declaration that the money it claims to have actually exists. Anyone can check this proof to make sure the exchange or wallet isn't simply inventing numbers.

Proof of reserves is a crucial component of the cryptocurrency ecosystem that keeps wallets and exchanges honest. Notably, there is a bigger danger of fraud if you use a service without proof of reserves.

An innovative mechanism for verifying digital assets on a blockchain is called proof of assets. This protocol makes it possible to confirm that real-world assets, including goods, real estate, and even pieces of art, are backed by real-world entities.

This enables the development of decentralised markets for these assets and offers up a vast array of new opportunities for the application of blockchain technology.

HBTC

Some

Read more on moneycontrol.com