Why is crypto market crashing today? Bitcoin sheds 6%, Ethereum dips 8%

Crypto markets are in a bloodbath on Monday due to macroeconomic conditions globally. The market is struggling to keep its 900 billion dollars valuation. Investors held a cautious position as they await US Fed's monetary policy outcomes amidst soaring inflation. The crypto leader Bitcoin has dipped to a three-month low, while Ethereum nosedived more than 8% during the day. The hype around Ethereum Merge has subsided and there are fewer catalysts in the crypto market currently. Also, the strengthening in the US dollar has further acted as a spoilsport in dampening global markets mood making cryptocurrencies vulnerable too.

At the time of writing, on CoinMarketCap, the global crypto market cap was at $914.50 billion down by 5.56% over the last day. However, there is a rise in total crypto market volume by 66.3% to $81.92 billion over the last 24 hours.

Meanwhile, the total volume in DeFi is currently $5.84 billion --- 7.13% of the total crypto market 24-hour volume. The volume of all stablecoins is now $74.80 billion --- which is 91.30% of the total crypto market 24-hour volume.

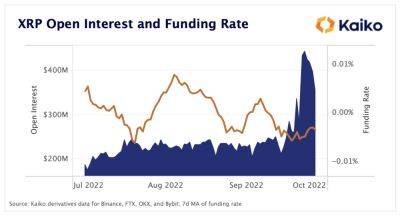

Bitcoin was trading near $18,765.08 down by 6.04%, while Ethereum traded at $1,314 plunging by 8.44%. Other major cryptocurrencies like BNB, XRP, Cardano, Solana, and Dogecoin tumbled between 4-8%.

Bitcoin's dominance stood at 39.34% at present lower by 0.19% over the day.

In the last seven days, Bitcoin and Ethereum shed nearly 16% and 25% respectively.

Among the gainers in the crypto market are --- Helium up by 4%, Terra ClassicUSD, and Neutrino surging more than 1% each. In the top underperforming list were -- Ethereum Classic dipping nearly 13%, followed by Kusama, Curve DAO Token, EOS, Celsius, and Ravencoin plummeting between nearly 11-12%.

Read more on livemint.com

![Ethereum Classic [ETC] is on a strong downtrend, can the bulls defend $25 - ambcrypto.com - city Santimentthe](https://gocryptonft.com/storage/thumbs_400/img/2022/9/30/70033_scsry.jpg)