What's Next for Crypto Prices as US Regional Banks Take a Hit? – yPredict Tool Makes AI Price Predictions Easy

The US banking sector is in the midst of a crisis, and the government's efforts have been insufficient, and some would even say damaging.

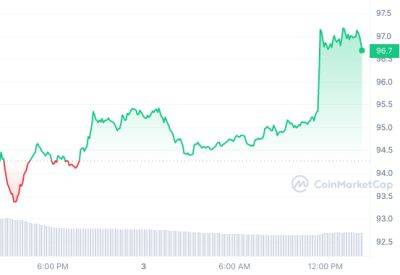

As regional banks face financial headwinds, the cryptocurrency market is on the lookout for ripple effects.

Amidst the crisis, yPredict's presale has received much attention for its AI-powered price predictions platform that can help predict market moves in both calm and volatile markets.

The US banking sector is in a crisis, and the government's response has been tepid at best.

The turbulence in the financial sector has been particularly pronounced for regional banks such as PacWest and Western Alliance, which have found themselves in the eye of the storm.

The crisis, which began with Silicon Valley Bank's collapse in March, has raised questions about the stability of the US banking system.

While central banks and experts quickly dismiss comparisons to the 2008 financial crisis, the situation is undeniably precarious.

The rapid rise in interest rates by the Federal Reserve, coupled with regulatory shortcomings and problematic business models, has left US banks vulnerable.

European banks, on the other hand, have largely weathered the storm, thanks mostly to stricter regulations.

The European Central Bank's vice-president, Luis de Guindos, even noted the superior performance of European banks compared to their American counterparts.

As the crisis unfolds, the US banking landscape is likely to undergo significant changes.

Consolidation, tighter regulation, and increased supervision are all on the horizon.

The Federal Deposit Insurance Corporation's intervention in the case of First Republic, which saw its assets sold to JP Morgan Chase, is indicative of the government's willingness to take action

Read more on cryptonews.com