What happens if SEC doesn’t appeal Grayscale spot Bitcoin ETF ruling?

The United States Securities and Exchange Commission will soon reach its deadline to appeal the court decision that ruled in favor of Grayscale Investments, forcing the regulator to review the fund manager’s application for a spot Bitcoin (BTC) fund.

While many observers don’t believe the securities regulator will attempt to appeal the court’s decision, analysts say there could still be ways for the SEC to delay approval of Grayscale’s spot Bitcoin ETF conversion.

On Oct. 13, the SEC must either appeal the D.C. Circuit Court of Appeals decision to the U.S. Supreme Court, request the Appeals Court revisit its ruling, or follow the court’s August order and review Grayscale’s bid to change its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

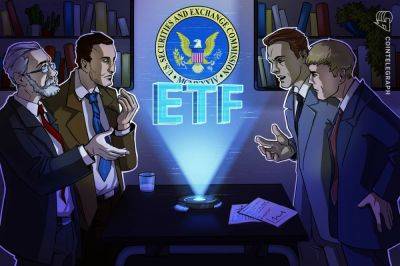

In an Oct. 12 post responding to an X user’s question, Bloomberg ETF analyst Eric Balchunas said an appeal was unlikely, though there could still be other hurdles.

Meanwhile, in a separate post, fellow Bloomberg ETF analyst James Seyffart said that an SEC attempt to deny on new grounds was unlikely and a “very difficult needle to thread,” but it could “find ways to keep delaying.”

Not officially. SEC could attempt to deny on new grounds but as @EricBalchunas, myself, @NYCStein, @SGJohnsson, @NateGeraci and many others have said. It would be a very difficult needle to thread and we view as unlikely. They can find ways to keep delaying though IMO.

A September note from law firm Ropes & Gray warned the GBTC application could be sent back for review to the SEC, giving the regulator another chance to reject it on a different basis.

“In this scenario, the new denial could itself then be subject to another appeal by GBTC to the D.C. Circuit,” wrote the firm.

Another delay scenario, according to

Read more on cointelegraph.com