Wall Street Grapples with Crypto Custody: Nasdaq's Decision Sparks Activity

A decision by the Nasdaq stock exchange to shelf its plans to launch a crypto custody service has led other US firms to also reconsider their planned push into crypto.

Following the Nasdaq news, major investment bank Citigroup is now also taking time to rethink its approach to crypto, with Bloomberg reporting on Monday that the bank is “reviewing its partnership” with Swiss crypto custody software provider Metaco.

At the same time, State Street, another major US asset manager, has axed its deal with the London-based crypto custody provider Copper Technologies, Bloomberg said.

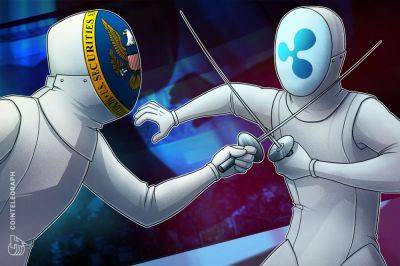

As with Nasdaq’s decision to move away from crypto, regulatory uncertainty in the US is believed to be a major reason for the firms to distance themselves from the nascent industry.

However, some things are also moving forward in the relationships between traditional finance and crypto-native firms.

In Europe, French banking giant Societe Generale has been granted a license by the country’s regulator that will allow it to offer crypto custody services.

The granting of the license to Societe General earlier this month made it the first entity in France to receive a crypto license, with other firms such as Binance and Bitstamp being merely “registered” and not “licensed,” the French regulator said at the time.

Meanwhile the UK-based asset manager Schroders is on the lookout for a crypto custodian to partner with, Bloomberg has previously reported.

According to sources that Bloomberg spoke with in June, the firm is actively searching for a third-party custodian to support its digital asset expansion, and Zodia Custody Ltd., a firm that is majority owned by UK bank Standard Chartered, is said to be among the shortlisted candidates.

In the US, regulatory scrutiny

Read more on cryptonews.com