US Spot Bitcoin ETFs See $117M in Inflows, Ethereum ETFs Register $11M

Ruholamin Haqshanas is a contributing crypto writer for CryptoNews. He is a crypto and finance journalist with over four years of experience. Ruholamin has been featured in several high-profile crypto...

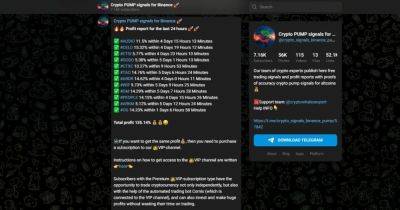

US spot Bitcoin exchange-traded funds (ETFs) saw inflows of approximately $117 million on Tuesday, marking a rebound after a recent period of outflows.

Fidelity’s Bitcoin Fund (FBTC) led the surge, attracting $63 million in net inflows, according to data from Farside Investors.

The boost brings the fund’s total net inflows to $9.5 billion after eight months of trading.

FBTC now holds $10.5 billion in Bitcoin, positioning it as the third-largest Bitcoin ETF, trailing BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC).

Other funds also saw strong performances. Grayscale’s Bitcoin Mini Trust (BTC), a lower-cost version of GBTC, and ARK Invest’s Bitcoin ETF (ARKB) attracted $41 million and $13 million, respectively.

However, BlackRock’s IBIT and other major Bitcoin ETFs experienced no inflows during Tuesday’s session.

The recent inflows follow a period of significant outflows, which began in late August and stretched into early September.

Over $1 billion was withdrawn during this time, with BlackRock’s IBIT suffering its second outflow since launching in January.

Despite these challenges, IBIT remains a dominant force, holding over $20 billion in assets.

In parallel, US spot Ethereum ETFs made a modest recovery, registering around $11 million in net inflows on Tuesday.

Fidelity’s Ethereum Fund (FETH) had an inflow of $7.1269 million, while BlackRock’s iShares Ethereum Trust (ETHA) had an inflow of $4.3101 million.

Other Ethereum ETFs saw no movement.

Ethereum spot ETF had a total net inflow of $11.437 million

Read more on cryptonews.com