Underdog rises: Dogecoin survived carnage in 2022 better than most

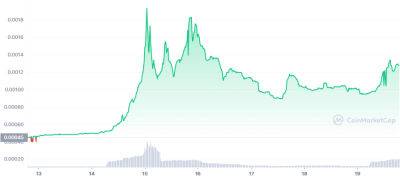

Amid the severe crypto downturn in 2022, the price of Dogecoin (DOGE) has held up much better than most of the top assets on the market.

DOGE is the third best performer in the top ten, dropping by 58% this year, beaten only by Ripple (XRP) and Binance Coin (BNB) which saw declines of 57.2% and 53.%.

Looking at the top 10 assets in terms of market capitalization as per Crypto Bubbles data, Bitcoin (BTC), Ether (ETH), Cardano (ADA) and Polygon (MATIC) have all shed considerably more: 65.1%, 67.8%, 80.9 and 68.8% a piece over the past 12 months.

DOGE also comes in well ahead of other big names in top 20 such as Polkadot (DOT), Solana (SOL), Uniswap (UNI) and Avalanche (AVAX) which have all plunged, by 84%, 93.8%, 70.3% and 89.9% each.

Data from Intotheblock (ITB) also has interesting insights, with the majority (54%) of DOGE hodlers currently in the green at the current price of $0.07, while 3% are breaking even and 43% in the red.

ITB’s figures rely on identifying the average cost of token purchases in its tracked wallets and comparing it to the current price of the given asset.

Looking at other assets, ITB data indicates that 46% of BTC holders and 47% of ETH holders are currently in the green at the time of writing, showing the memecoin has performed well despite its volatile history.

The strong performance comes despite no significant news for the Dogecoin network or anything in the pipes to justify excitement going forward, bar some recent speculation that DOGE could potentially, possibly, one day be integrated with Elon Musk’s Twitter.

By way of comparison Ethereum cut its energy consumption rates by 99% this year, with a slew of layer 2 projects helping it to scale. Fundamentals don't have the power of Memes

Read more on cointelegraph.com