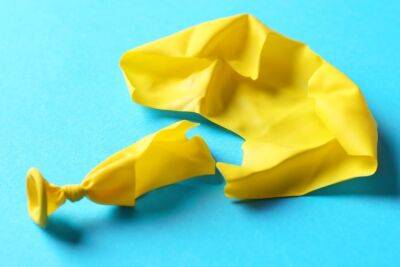

Top cryptocurrency prices today: Bitcoin, Ethereum, BNB, Tron plunge up to 17%

Bitcoin, along with other major crypto tokens nosedived in the last 24 hours, hurting investors' portfolios badly. Bitcoin, akin to other peers, has wiped off about 70 per cent of its value from peak. It plunged to the lowest in about 18 months after the freezing of withdrawals by the Celsius lending platform added to concern that systemic risk in the crypto ecosystem will accelerate the digital-asset market meltdown. Apart from this, recession and inflation fears also haunted investors.

Presented ByDid you Know?

Fan tokens or sports crypto are digital assets that enable sports teams, leagues, clubs, associations and players to strengthen fan engagement.

View Details »Majority of the crypto tokens were in deep red. Bitcoin, Ethereum, BNB and Tron plunge between 10-17 per cent. However, a mild recovery was witnessed in Polkadot and Avalanche after solid hammering. The global cryptocurrency market cap was trading sharply lower at the $908.51 billion mark, dropping as much as 11 per cent in the last 24 hours. However, the total cryptocurrency trading volume zoomed about 64 per cent to $153.34 billion.Expert takeBitcoin plunged significantly over the past 24 hours and is trading at $21,000 with increased selling pressure since the weekend, said Edul Patel, CEO and Co-founder of Mudrex. «If sellers are determined, Bitcoin can fall to $20,000.» The market continued to slip following the rise in inflation in the US, he added. «There is a sharp carnage in the crypto markets and the community is under severe distress. Bitcoin and other tokens have a little comfort to offer to investors. It's havoc to be exact,» said Kunal Jagdale, Founder & CEO, BitsAir Exchange. Bears are in ruckus mode and crypto investors have no refuge now

Read more on economictimes.indiatimes.com