Terra Luna Price Chart Prediction – How High Can LUNC Pump in 2023?

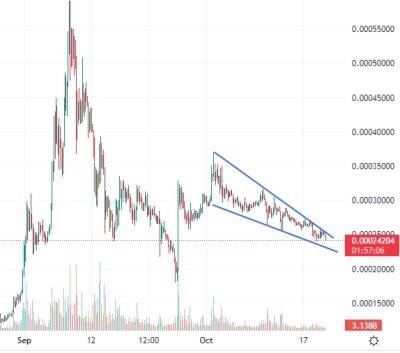

The terra luna classic price has fallen by 0.5% in the past 24 hours, dropping to $0.00026412. This also represents an 8% dive in a week and a 15% correction in a month, with LUNC's depreciation over these timeframes outpacing falls witnessed by other major coins and the market as a whole.

Such above-average declines suggest that terra luna classic's rallies over the past few weeks may have come to an end, with the release of Binance's latest data for its ongoing LUNC burns doing little to prevent today's dip, even though the market's total cap is up today. And with the collapsed altcoin still having a supply of around 6.9 trillion, it will take many, many more burns before it can begin to enjoy consistent gains.

LUNC's technical indicators suggest a lack of momentum at this moment in time. Its relative strength index (purple) has dipped again below 50 after a momentary jump above this level yesterday, while its 30-day moving average (red) is sinking further below its 200-day (blue)

This signals that LUNC is currently experiencing a lull, having had a very good September (and a good start to October). Depending on your perspective, this could mean that it can now be had at a discount relative to its 'true' value, or that it's part of a longer term stagnation.

To be fair, LUNC has had some good news in recent weeks. Not only did the Terra protocol introduce a 1.2% tax burn on all LUNC and USTC transactions in early September, but more recently Binance has launched its own additional burn of all the trading fees it collects in LUNC.

The announcement of the tax burn was responsible for LUNC's rally in early September, while Binance's announcement of its trading fee burn (on September 26) has been responsible for the coin's more

Read more on cryptonews.com

![Daniel Shin - Terra LUNA Classic [LUNC] Price Prediction 2025-2030: Will LUNC reach $0.028 by 2025 - ambcrypto.com - South Korea - city Seoul, South Korea](https://gocryptonft.com/storage/thumbs_400/img/2022/10/15/73379_ly3j.jpg)