Solana Price Prediction as SOL Reaches Highest Level Since December 2021 – Can SOL Overtake Ethereum?

Solana’s price prediction gains attention amid broader industry developments, such as Marathon Digital’s strategic expansion and legislative appeals to the SEC regarding cryptocurrency ETFs.

Solana’s performance indicates potential shifts in the future landscape of blockchain technology.

Marathon Digital’s latest move to acquire a 200MW Bitcoin mining facility in Texas for $87.3 million marks a significant leap in its operational capacity, now reaching 1.1 gigawatts. This expansion is poised to:

Targeting ownership and operation of 54% of its mining infrastructure by 2024, Marathon underlines its commitment to enhancing its footprint in the blockchain sector.

Despite facing a potential hurdle with the upcoming Bitcoin halving in mid-April—which could reduce mining rewards by half—the company has seen a revenue boost in 2023, thanks to increased production levels and Bitcoin’s price increase.

Additionally, Marathon’s new service for faster Bitcoin transactions underscores its innovative approach to blockchain technology.

Marathon to purchase 200MW Bitcoin mining center from Applied Digital for $87.3Mhttps://t.co/112y2U6gKs

— John Morgan (@johnmorganFL) March 15, 2024

This strategic acquisition not only reinforces Marathon’s role in strengthening the Bitcoin network but also may indirectly influence the broader blockchain ecosystem, including networks like Solana.

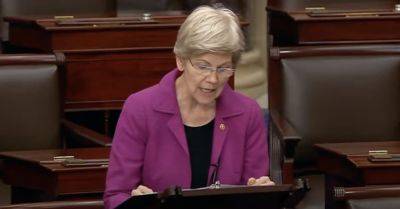

Two US senators have called on SEC Chairman Gary Gensler to stop endorsing new cryptocurrency exchange-traded funds (ETFs), highlighting the risks of fraud and manipulation especially in cryptos beyond Bitcoin.

They emphasize Bitcoin’s relative stability compared to other cryptocurrencies and suggest the SEC’s focus should remain on ensuring investor protection,

Read more on cryptonews.com