Solana Price Prediction as SOL Drops 5.5% – Time to Buy the Dip?

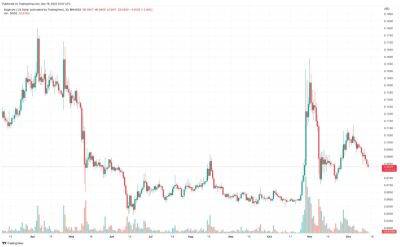

SOL, the cryptocurrency that powers Solana’s higher performance smart-contract enabled blockchain, has stabilized in the $13.50 area on Thursday after falling back from the mid-$14.00s on Wednesday. Versus its earlier weekly highs in the $14.40 area, SOL is currently down about 5.5% and some traders are asking whether it is time to buy the dip once again.

While SOL is for now finding support at its 21-Day Moving Average, which currently resides close to $13.50, betting in favor of the cryptocurrency in the context of the current markets remains risky. SOL still trades about 65% lower versus its pre-FTX/Alameda collapse highs in the $38 area, with traders concerned about the future of the blockchain project owing to its close ties to the now-defunct cryptocurrency exchange and its sister hedge fund.

Until uncertainty about the Solana Foundation’s future (i.e. funding) becomes clearer, SOL sentiment may struggle to see a lasting lift. A break back below the 21DMA could herald a move back lower towards the November lows under $11.

But if risk appetite returns to cryptocurrency markets in the coming weeks, perhaps triggered by further downside US inflation surprises, or perhaps a not-as-hawkish-as-feared December Fed meeting, or by a “Santa rally”, and SOL can muster a sustained push above its 21DMA, it will face tough resistance in the $19 area. This is a key long-term resistance-turned-support area dating back to the first half of 2021. The next key area of resistance would then be the pre-FTX collapse 2022 lows in the $26.50 area.

Prior to FTX’s untimely demise in early November, Serum, a DEX created back in 2020 by a consortium including FTX and Alameda, had functioned as a central source of liquidity for the Solana

Read more on cryptonews.com