So what if Bitcoin price keeps falling! Here is why it’s time to start paying attention

For bulls, Bitcoin’s (BTC) daily price action leaves a lot to be desired, and at the moment, there are few signs of an imminent turnaround.

Following the trend of the past six or more months, the current factors continue to place pressure on BTC price:

When combined, these challenges have made high volatility assets less than interesting to institutional investors, and the euphoria seen during the 2021 bull market has largely dissipated.

So, day-to-day price action is not encouraging, but looking at longer duration metrics that gauge Bitcoin’s price, investor sentiment and perceptions of valuation do present some interesting data points.

On the daily and weekly timeframe, BTC’s price is pressing against a long-term descending trendline. At the same time, the Bollinger Bands, a simple momentum indicator that reflects two standard deviations above and below a simple moving average, are beginning to constrict.

Tightening in the bands usually occurs before a directional move, and price trading at long-term resistance is also typically indicative of a strong directional move.

Bitcoin’s sell-off from March 28 to June 13 sent its relative strength index (RSI) to a multi-year record low, and a quick glance at the indicator compared against BTC’s longer-term price action shows that buying when the RSI is deeply oversold is a profitable strategy.

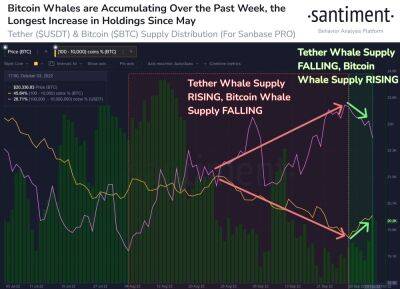

While the short-term situation is dire, a price agnostic view of Bitcoin and its market structure would suggest that now is an opportune moment to accumulate.

Now, let’s contrast Bitcoin’s multi-year price action over the RSI to see if any interesting dynamics emerge.

In my opinion, the chart speaks for itself. Of course, further downside could occur, and various technical and on-chain

Read more on cointelegraph.com

![Bitcoin [BTC] is finally seeing green, but what role did the whales play - ambcrypto.com - city Santiment](https://gocryptonft.com/storage/thumbs_400/img/2022/10/6/71380_dbxej.jpg)