SEC Cracks Down on Stablecoins, Targeting Paxos

U.S. regulators may take enforcement action against Paxos Trust Co. over the stablecoin it issued, ramping up a growing crackdown on cryptocurrencies. The Securities and Exchange Commission (SEC)'s decision isn't final, according to the Wall Street Journal. If the SEC does decide to sue Paxos, on the basis that its stablecoins violate laws designed to protect investors, the case would follow another in which the regulator sued Terraform Labs and CEO Do Kwon for a multi-billion dollar fraud involving the algorithmic stablecoin TerraUSD (UST).

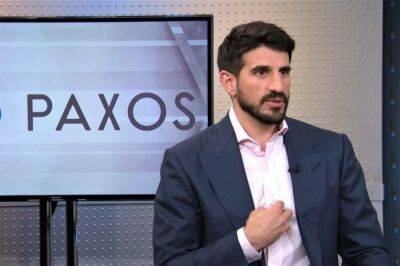

Different regulators last week forced Paxos to cease issuing the BUSD Binance stablecoin, ending an exclusive partnership with the world's largest crypto exchange. Paxos said it's holding «constructive talks» with regulators.

«The market has evolved and the Binance relationship no longer aligns with our current strategic priorities,» Paxos CEO Charles Cascarilla said in an email to employees over the weekend. BUSD, released in 2019, has a market value of $12 billion, making it the third-largest stablecoin. Yet it's taken a hit on the regulatory news, losing about $2.5 billion, according to Binance founder Chanpeng Zhao, who tweeted «the landscape is shifting» as money flows into Tether's USDT.

The SEC has intensified its regulatory efforts against cryptocurrencies in the wake of the sudden collapse of FTX. San Francisco's Kraken exchange was forced to shut down its U.S. staking business earlier this year, a move that rattled the top exchanges.

The regulator's action against Terra reignited a debate about cryptocurrencies as securities. A former CFTC employee, lawyer Mike Selig, tweeted that the SEC decision to categorize UST as a stablecoin could set a precedent for anything to be

Read more on investopedia.com

![Cardano [ADA] sees a decline in key growth metrics in Q4 2022 - ambcrypto.com](https://gocryptonft.com/storage/thumbs_400/img/2023/3/18/91416_qbuam.jpg)