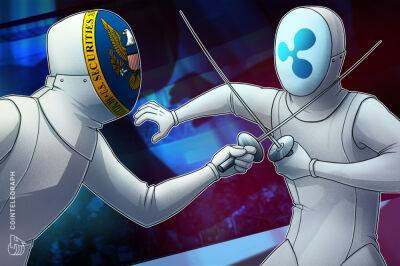

Ripple, SEC Seek Summary Judgement to End Case Soon and Why That’s Likely Bullish for XRP

In another installment of the long-term legal battle pitting U.S. blockchain company Ripple against the U.S. Securities and Exchange Commission (SEC), both entities have asked for a swift judgment in the agency’s case against the company.

The two parties are currently seeking a so-called summary judgment, indicating that neither the plaintiff nor the defendant want the legal action to evolve into a full trial, according to court documents filed on September 13 and obtained by news site Theblock.co. Owing to this, Ripple’s legal woes could be resolved relatively soon, potentially boosting its native token’s price.

The American regulator’s case against the business is centered on the accusation that its token, Ripple (XRP), is an unregistered security. Ripple claims its native token is not a security and rejects the SEC’s accusations. The agency has also been making efforts to extend the charges to the company’s executives, and secure the personal financial records of Ripple’s CEO Brad Garlinghouse and its Executive Chairman Chris Larsen.

The SEC has objected to a judge’s order that required the agency to disclose drafts of a 2018 speech made by William Hinman, the former Director of the SEC’s Division of Corporation Finance, in which he declared that opining that bitcoin (BTC) and ethereum (ETH) are not securities, and thus are not subject to the regulator’s oversight. In January 2022, Ripple secured the permission to access a much-contested document containing quotes by the agency’s former official.

Last August, in another legal win for Ripple, a judge granted its defendants’ motion to authenticate videos of seven public remarks made by SEC officials, while at the same time ignoring the SEC’s claim that the defendants were

Read more on cryptonews.com