Price analysis 5/26: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

Bitcoin (BTC) remains pinned below $27,000 and the recent weakness of the past few days has increased calls from analysts for a fall to the low $20,000 levels. While anything is possible, the bulls are unlikely to give up the $25,000 support without putting up a fight.

Glassnode’s lead on-chain analyst Checkmate said in his comments on May 24 that the Sell-side Risk Ratio metric suggests that “sellers are exhausted on both sides” and that indicates big moves “are coming.” The last time the Sell-side Risk Ratio was this low was in late 2015, which started the bull run that reached $20,000 in December 2017.

Another short-term positive is that market observers expect a debt ceiling deal to be reached and that has boosted the price of the United States equities markets on May 26. If the risk-on sentiment sustains, it could increase demand for Bitcoin and select altcoins.

What are the crucial resistance levels in Bitcoin and the major altcoins that need to be crossed for a sustained recovery to begin? Let’s study the charts of the top-10 cryptocurrencies to find out.

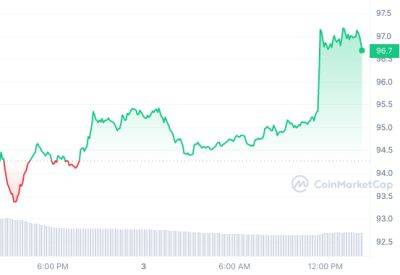

Bitcoin bounced off $25,871 on May 25, close to the strong support zone of $25,811 to $25,250. The bulls will try to push the price to the 20-day exponential moving average ($27,173).

This level may again attract strong selling by the bears. If the price turns down from the 20-day EMA, it will signal a negative sentiment where the bears are selling on rallies.

The crucial level to watch on the downside is $25,250. The bulls are expected to defend this support with all their might because if this level crumbles, the BTC/USDT pair may fall to $24,000 and eventually to $20,000.

On the contrary, if bulls pierce the overhead resistance at the 20-day EMA, the pair could rise

Read more on cointelegraph.com