Nigeria Faces Pressure to Tighten Crypto Regulations for Financial Crime Prevention

Nigeria faces calls to go further in its efforts to clarify crypto regulation after a blockchain firm successfully finished training its fifth cohort of crypto compliance specialists last weekend.

Blockchain intelligence service provider A&D Forensics teaches a course on curbing financial crimes committed on-chain, particularly money laundering, hacking and sanctions evasion. It also teaches trainees about crypto compliance laws in various jurisdictions.

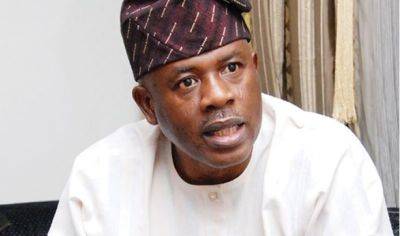

Speaking to the local press, the company’s co-founder Adedeji Owonibi said that the training will help ensure that banks are complying with recently passed guidelines on dealing with Virtual Asset Service Providers (VASPs).

Owonibi argues that a more comprehensive regulatory framework would help Nigeria reduce the rate of financial crimes in its territory. He added that the legal status of VASPs (like exchanges) is currently uncertain, as they don’t know whether they fit the definition of money transmission institutions, and are thus subject to the same regulations.

He also said that banks must thoroughly vet VASPs for any signs of criminal activity before opening accounts for them, since the Nigerian Central Bank’s guidelines implicates the banks as accomplices in cases of proven criminality.

Owonibi called on the state to “intensify her efforts” for comprehensive legislation, adding that “if there is no law, there is no offense.”

Speaking of his training work with A&D Forensics, Owonibi said: “We have had Law Enforcement agents, participate in our trainings, we have the cryptocurrency investigators course, where we had police officers and officers of the Economic and Financial Crimes Commission (EFCC) come and get trained and we are currently working with Nigerian Financial

Read more on cryptonews.com