Musk-driven Dogecoin surge is a warning to Twitter

The bursting of social media’s ad-funded bubble is creating big market waves. Meta Platforms Inc. is less valuable than Home Depot Inc., Snap Inc. is worth less than Deutsche Bank AG (which underwrote its IPO), and Twitter is now privately owned by Elon Musk after almost a decade of cumulative stock-market underperformance.

The depressing sight of Dogecoin jumping 100% in one week on hopes of a more cryptocurrency-oriented direction for Twitter, however, suggests we are a long way from a new model that might help humanity or that’s genuinely “decentralized," ambitions Musk has expressed for his newly acquired platform. The token got another boost Tuesday after Musk tweeted a picture of a Shiba Inu wearing a Twitter t-shirt.

While the current price of Dogecoin is a pittance compared to last year’s all-time high, when peak pandemic irrationality saw the crypto-desperate seduced by Musk’s backing of the token, its theoretical market capitalization of $15 billion shows speculative habits die hard among the billionaire-worshipping faithful.

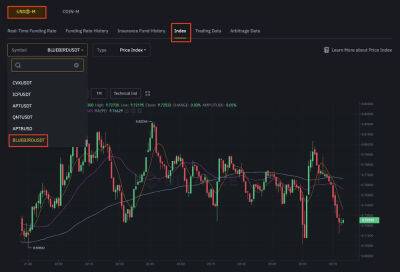

The narrative being spun in crypto circles is that Musk’s past vocal support for Dogecoin will lead to the token’s integration into Twitter as a payment method. Extra impetus comes from the fact that crypto exchange Binance — which helped finance Musk’s takeover — is forming a team to look at “ways that blockchain and crypto could be helpful to Twitter," according to a statement.

Never mind that this is all currently theoretical, or that Dogecoin has glaring flaws that would be only further exposed if it gained traction. The rules of follow-the-herd “mimetic" investing are to dance until the music stops which, judging by past Dogecoin jumps and slumps, is only a matter of time. One

Read more on livemint.com