Is It Too Late to Buy Chainlink? Link Price Rockets 11% as Surprising New Meme Coin Secures $650,000 in Funding – What's Going On?

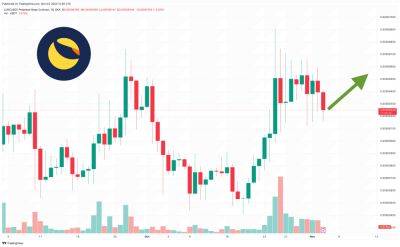

After more than 15-months of tight ranging price action, Chainlink (LINK) has shot-up +11% in a potential break-out trend, yet, as the underwater LINK army goes on parade - is it too late to buy Chainlink?

The past year of trading has seen leading Oracle Chainlink trapped between $5.50 and $9.50, in a predictable chop that has left bag-holders in purgatory.

Yet, the sudden break-high, triggered by a Chainlink blog-post suggesting the launch of a V0.2 upgrade to LINK staking is expected to come later this year - with new features including an unbonding mechanism, liquid staking rewards, and a shift of the stake slash burden from stakers to validators.

The upside move was predicted by top-tier crypto trader VikingXBT, who has withstood the wrath of many disillusioned LINK holders in recent weeks, as he shepherded the LINK army through challenging price action.

With Chainlink manoeuvring towards the V0.2 upgrade, LINK is currently trading at a market price of $10.29 (representing a 24-hour change of +1.04%).

At the time of writing LINK price appears to be shifting into minor localised retracement, with price down -7.53% from a local high of $11.06 over the last 6 hours.

The sudden move, triggered by the update from the Chainlink Foundation, coincided with a crucial push back above the ascendant 20DMA over the weekend.

This comes following the emergence of a 'golden cross' pattern on September 29.

With price trading on a break-out, LINK could now find lower support at the $9.50 level.

Meanwhile, LINK's indicators are reflecting the dramatic move, with the MACD showing bullish divergence at 0.281.

However, warning signs are appearing on the RSI indicator, which has overheated with serious bearish divergence to an extremely over-bought

Read more on cryptonews.com