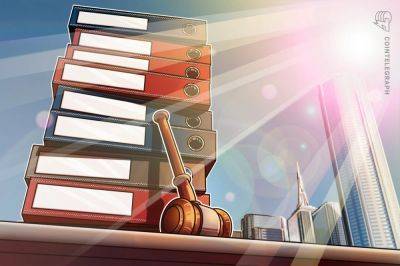

Indian Government Misses on $420 Million in Crypto Taxes as 90% Trade Volume Shifts Offshores: Report

The imposition of a one percent tax-deducted-at-source (TDS) on the trading of cryptocurrencies in India has led to a massive shift of millions of users to offshore crypto exchanges, according to a recent report published by the Esya Centre.

In February 2022, India’s Ministry of Finance introduced a one percent TDS on crypto transactions with the aim of reducing speculative activity and increasing transparency within the crypto ecosystem.

With many crypto users migrating to offshore exchanges, Indian government has not achieved what it set out to with its 1% TDS on crypto transactions.

The Esya Centre’s report has revealed that implementation of 1% tax resulted in the loss of potential revenues of approximately $420 million (Rs. 3,493 crores) compared to the collected revenue of just $30 million (Rs. 258 crores).

India’s digital economy missed out on opportunities worth four to five times this value due to foregone positive externalities.

Domestic Indian crytp exchanges accounted for 97% of the collected revenue, contributing approximately $29 million (Rs. 250 crore), while trades by Indians on offshore platforms contributed only $840,000 (Rs. 7 crore), which is just 0.2% of the $420 million (Rs. 3,500 crores) that should have been collected.

The Esya Centre report drew data from both Indian and global crypto ecosystems, analyzed transaction volumes from 13,000 peer-to-peer (P2P) traders, and surveyed executives working at India’s leading crypto exchanges to assess the impact of the one percent TDS levy.

So far in this financial year, Indian government has only collected $12 million from 1% TDS on crypto transactions.

The report reveals that between February 2022 and July 2022, three to five million Indian users shifted to