How to Start Generating Passive Income with Cryptocurrency? Staking Cardano (ADA) and by Simply Holding Gnox Token (GNOX)

Disclaimer: The text below is an advertorial article that was not written by Cryptonews.com journalists.

Investing in fundamentally strong projects is one way of making money in the crypto market. However, with thousands of projects flooding the space every day, it takes a lot of research to thread the needle. Even then, there’s no guarantee for long-term appreciation.

One of the best ways to survive crypto winter is to have a passive source of income, which is now possible with the introduction of Decentralized Finance. It is easy to setup and requires only little effort to maintain a growing portfolio. Below are two simple ways to see your money compound over time.

With a proof-of-stake mechanism, Cardano is the ultimate choice when it comes to putting some extra cash in your pocket. You can either stake ADA by starting your own stake pool or delegate it to a reputed one. The first option is more rewarding, but you have to invest in acquiring technical knowledge and maintaining a reliable server. If that’s not in your wheelhouse, you can still earn good passive income by delegating your ADA to existing pools.

Yoroi and Daedalus are two popular Cardano wallets that allow users to stake ADA, with a typical payout ranging between 3-6%. For investors with the limited technical know-how of wallets, they can simply stake ADA on crypto exchanges like Binance and Gemini. With more than 70% of the supply at stake, Cardano is one of the most reliable income generators in the crypto-verse.

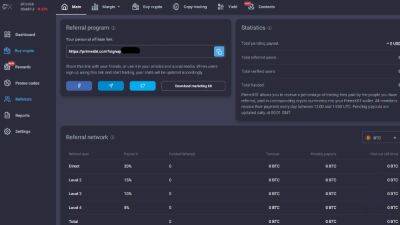

In a bid to drive greater adoption, Gnox simplifies DeFi earnings even for a layman. Anyone can buy and hold GNOX to earn consistent passive rewards distributed by the protocol. There’s no need to set up any wallets or delegate your holdings to a

Read more on cryptonews.com

![Cardano [ADA] bulls set their eyes on these two short-term resistances - ambcrypto.com](https://gocryptonft.com/storage/thumbs_400/img/2022/6/17/48646_jqk9.jpg)