Hot take: Bitcoin’s [BTC] next bull phase might be driven by energy companies…

Bitcoin, the largest cryptocurrency started a fresh increase from the $28,500 support zone against the US Dollar. At press time, the token crossed the $30k mark as it witnessed a 3% surge in the past 24 hours. But there’s a potential for more. BTC could rally if there is a clear move above the $30,600 resistance zone.

Different factors, for instance, institutional adoption, have aided the largest crypto to reach new heights within the crypto market. However, energy companies might be next to drive the next BTC bull run. Ki Young Ju, CEO of analysis platform CryptoQuant, in a series of tweets shared this narrative. In his opinion, energy companies will drive the next BTC bull run alongside traditional finance institutions.

“The first change we’ll see is that the BTC network will be run by solar and wind which became the most cost-effective electricity source lately.”

Here’s a graphical representation of how this might play out:

Source: Twitter

In fact, the U.S Energy Information Administration’s statistics highlighted that the largest increases in U.S electric power generation for summer 2022 will come from solar and wind. As per the executive, ‘Hydroelectric energy is the most common source for Bitcoin mining globally. It gets used by 62% of crypto miners. Solar and wind take 15-17% for now.’

<p lang=«en» dir=«ltr» xml:lang=«en»>Hydroelectric energy is the most common source for Bitcoin mining globally, and it gets used by 62% of crypto miners. Solar and wind take 15-17% for now.Last week, @EIAgov said the largest increases in U.S. electric power generation this summer will come from solar and wind. pic.twitter.com/zt78DPzbFP

— Ki Young Ju (@ki_young_ju) May 23, 2022

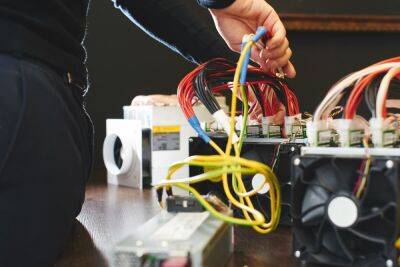

Over the years, the Bitcoin mining industry has become more

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com![Why Bitcoin [BTC] could linger around $27k until the end of Q2 2022 - ambcrypto.com](https://gocryptonft.com/storage/thumbs_400/img/2022/5/30/44707_htn.jpg)

![Bitcoin’s [BTC] short-term recovery chances looks bleak thanks to… - ambcrypto.com](https://gocryptonft.com/storage/thumbs_400/img/2022/5/29/44477_3k5h.jpg)