Here’s what crypto traders are doing with volatility gone

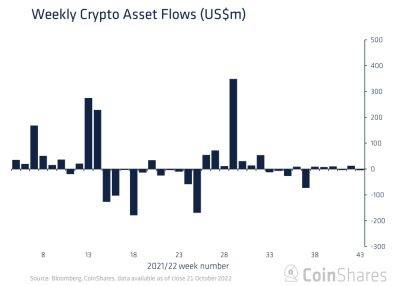

Besides dangling the opportunity to get rich quickly, one of the biggest attractions for crypto traders was the ability to profit from wild price swings. Now with volatility all but gone -- at least for now -- both professionals and amateurs are altering their strategies as the crypto winter drags on.

A volatility gauge for Bitcoin has dropped in recent days to its lowest level since April, reaching 61 on Friday. That’s a far cry from the 140 it hit in May amid the collapse of the Terra stablecoin ecosystem. After surging to an all-time high of almost $69,000 in November, the largest digital asset by market value has been trading in a narrow range of around $20,000 since June.

Which begs the question: what exactly are crypto traders and investors, accustomed to the twists and turns of the asset class, doing now to make money?

Bloomberg News talked to a number of investors and traders about what they’ve been doing to survive the chill. Here’s a by no means complete list of recent strategies:

Selling Options

Julian Koh, co-Founder and CEO of Ribbon Finance, a structured investment products protocol for DeFi, says his firm’s seen “increased demand to sell options," which can make money in a sideways market. Ribbon over the past month reached $100 million in total value locked (a crypto term to denote funds deposited in a project) from $70 million, and its options vaults are “doing well in this environment," Koh says.

“Basically it’s a way for people to express the view that markets will continue to be flat and still make money," he added.

Staking

Steven McClurg, co-founder and chief investment officer at digital-asset fund manager Valkyrie Investments, has been risk-off for most of the year. But he says Bitcoin’s a

Read more on livemint.com