Genesis Has $2.8 Billion in Outstanding Loans, Parent Company DCG Was Lent Substantial Amounts - Here’s What You Need to Know

Troubled crypto trading and lending firm Genesis Global has lent out some $2.8bn to various crypto firms, including large loans to its parent company, Barry Silbert’s Digital Currency Group (DCG).

The outstanding loans on Genesis’ balance sheet also consisted of intercompany loans, such as one from lending subsidiary Genesis Global Capital to the crypto brokerage Genesis Global Trading. The latter subsidiary is a key player in the crypto industry, acting as an important counterpart for many of the largest crypto firms.

The news was reported by Bloomberg on Tuesday, with the article citing people “familiar with the matter.”

The report also cited a letter by Digital Currency Group CEO Barry Silbert to shareholders, where Silbert revealed that DCG owes $575m to Genesis, with payment due in May of 2023.

The letter further described a so-called promissory note owed by Genesis to DCG worth $1.1bn, which will come due in June 2032. The loan was reportedly set up when DCG assumed some of Genesis’ liabilities following the collapse of crypto hedge fund Three Arrows Capital in early July this year.

Media reports at the time indicated that Genesis had exposure to Three Arrows Capital and the troubled crypto lender Babel Finance worth “hundreds of millions” of dollars.

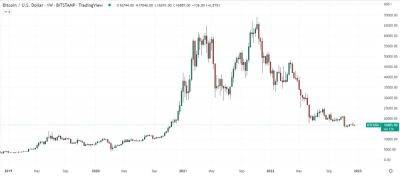

Genesis Global Capital suspended redemptions for clients on November 16, sending shockwaves through the industry and markets.

Besides the above-mentioned loans, DCG’s only debt is a $350 million credit facility “from a small group of lenders led by [venture capital firm] Eldridge,” Silbert’s letter said.

“Let me be crystal clear: DCG will continue to be a leading builder of the industry and we are committed to our long-term mission of accelerating the development of a better

Read more on cryptonews.com