FTX’s collapse could change crypto industry governance standards for good

The crypto market is often referred to as the Wild West of the finance world. However, the events that have unfolded within this space recently would put to shame even the hardiest of cowboys from the day of yore.

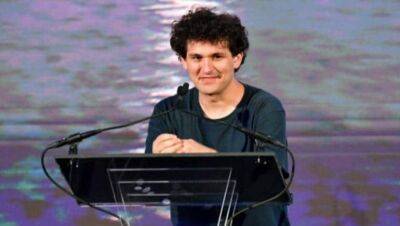

As a quick refresher, on Nov. 8, FTX, the second-largest cryptocurrency exchange in the world till about a month ago, faced an unprecedented liquidity crunch after it came to light that the firm had been facilitating shady deals with its related firm Alameda Research.

In this regard, as 2022 continues to be rough on the global economy, the crypto sector, in particular, has been ravaged by a series of meltdowns that have had a major impact on the financial outlook and investor confidence in relation to this maturing industry. To this point, since May, a growing number of prominent projects associated with this space— such as Celsius, Three Arrows Capital, Voyager, Vauld and Terra, among others — have collapsed within a matter of months.

FTX’s downfall specifically has been extremely damaging for the industry, as evidenced by the fact that following the company’s dissolution, the price of most major crypto assets dipped majorly, having shown no signs of recovery thus far. For example, within just 72 hours of the development, the value of Bitcoin plummeted from $20,000 to approximately $16,000, with many experts suggesting that the flagship crypto may bottom out close to the $10,000–$12,000 range, a story that has been mirrored by several other assets.

One pertinent question that the recent turbulence has brought to the forefront is what the future now holds for digital asset exchanges, especially centralized exchanges (CEXs). To get a better overview of the matter, Cointelegraph reached out to Dennis Jarvis, CEO of

Read more on cointelegraph.com