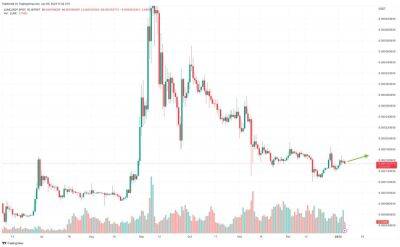

Ethereum Price Prediction as $4,500,000,000 Trading Volume Comes In – Where is the ETH Bottom?

Ethereum price exhibits a bearish bias that could see it explore more downstream levels. The bullish outlook from last week could no longer hold after ETH slipped below $1,200. ETH now trades at $1,196 on Wednesday during the European session. It may be in grave danger of dropping below a triangle pattern's support.

According to live price data, as shared by CoinMarketCap, trading volume spiked by more than 23% in 24 hours to $4,513,634. The world's second-largest cryptocurrency boasts $146 billion in market cap following a 2% drop over the same period.

Ethereum may undoubtedly finish 2022 in shambles after losing 70.4% of its value in one year and 75.5% from its all-time high of $4,878 – posted on November 10, 2021. However, according to a popularly known crypto analyst, Guy of Coin Bureau, next year could be an exceptional year for the largest smart contracts token.

The analyst cites the Ethereum Shanghai upgrade, scheduled for release in the first quarter of 2023, saying Ether could reverse the trend bullishly as investors unstake tokens locked in the smart contract. He reckons that when investors witness the billions of dollars unlocked, they may be lured into staking their tokens for a hustle-free investment journey.

"When they see that that ETH can in fact be unstaked and easily sold, then it might incentivize them to actually stake themselves. So, I really think it could go either way. Now, I wouldn't at all be surprised if it was slightly bearish in the short term if we do see some selling," Guy of Coin Bureau said in part.

Analysts and investors are all looking forward to the Shanghai upgrade, which, in addition to unlocking the staked Ether, would pave the way for scaling and advancing the Ethereum Improvement

Read more on cryptonews.com