Dogecoin Price Prediction: Can DOGE Recover After Elon Musk Loses the Title of World's Richest Person?

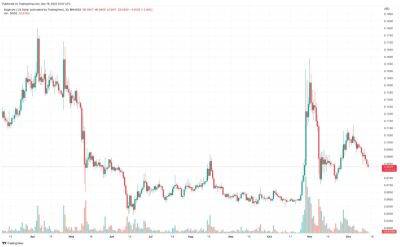

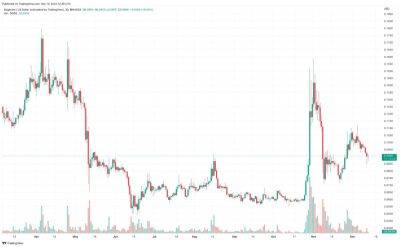

It’s been a tough month so far for DOGE, the ticker for Dogecoin, the native cryptocurrency of the Dogecoin blockchain. Dogecoin was unable to muster sustained upside on Tuesday in wake of softer-than-expected US inflation data, failing in its attempts to push back above $0.095 after finding resistance at its 21 and 50-Day Moving Averages.

The dog meme-inspired cryptocurrency has since dropped back under $0.09 once again on Wednesday amid a more hawkish than the market was expecting tone on the need for further interest rate rises from the US Federal Reserve at its latest policy announcement. At current levels around $0.089, DOGE/USD is changing hands lower by around 2.3% on the day on Wednesday and is down around 4.0% this week and 16% this month. Price predictions thus remain subdued.

The bulls had been hoping for a so-called “Santa Rally” to save the day, but it is currently looking much more likely that Dogecoin is going to emulate its December in 2021, where it lost over 20% than its December in 2020, when it surged 24%.

Dogecoin’s promising end to November which had some bulls hoping for a retest of the post-Elon Musk takeover of Twitter high in the $0.16 area did not translate into further Dogecoin upside in December. Indeed, the cryptocurrency for now appears content to ebb within recent ranges and doesn’t seem to carry much of a bullish or bearish technical bias for the time being. According to DOGE/USD’s 14-day Relative Strength Index score of above 40, Dogecoin is currently fairly positioned.

DOGE/USD is close to the 61.8% Fibonacci retracement level back from the early November highs around $0.16 to the annual lows under $0.05, having failed to hold above the 50% Fibonacci level a few weeks ago. Dogecoin

Read more on cryptonews.com